Checking Plus

Get everything that’s irregular about our regular checking accounts, plus grow your money by earning dividends.

Go Beyond Ordinary with Checking Plus

Checking Plus is even better than Regular Checking. You see, our regular checking accounts are actually not very regular because they are straightforward and simple: no fees, no stipulations, and no hassles. Well, Checking Plus is even better because it has everything regular checking has, plus you earn dividends when your account balance is $10,000 or more.

Checking Plus is free when your account balance is $10,000 of more, otherwise it costs just $10 per month.

Benefits

- Grow your money by earning dividends

- Get all the benefits of regular Checking

Many people come talk to us to open an account or take out a loan.

When we talk about a checking account they tell us their bank pays interest on their checking account and are “all set.” As they learn more and dig into what they have, they find they may be earning nominal interest, but there are so many fees and stipulations that the checking balance takes one step forward and two steps back.

We have no strings attached to our Checking Plus

Just keep your balance above $10,000 and earn dividends.

No required usage, no per check charge

Just a great account that rewards you for good habits.

Rates

| TERMS | APY | DIVIDEND RATE |

|---|---|---|

| $10,000+ account balance | 0.35% | 0.35% |

APY = Annual Percentage Yield. Minimum Opening Deposit is $10,000.00. Minimum Balance Fees Apply. Other fees may apply. Fees could reduce earnings on your account. Dividend rates may change at any time. |

||

Calculate

The accuracy of our calculators and their applicability to your circumstances are not guaranteed. You should consult with a qualified professional regarding your particular circumstances.

The accuracy of these calculators and their applicability to your circumstances are not guaranteed. You should consult with a qualified professional regarding your particular circumstances.

Fees

| DESCRIPTION | FEE |

|---|---|

| If Checking Plus balance is $10,000+ | Free |

| If Checking Plus balance is below $10,000 | $10 / mo |

| Other fees may apply. Refer to our full fee schedule for further information. Fees could reduce earnings on your account. Dividend rates may change at any time. | |

Frequently Asked Questions

Can an automatic deduction come from either a savings or checking account?

Yes. To set up an automatic deduction you will need our routing number (222380731) and your member number.

When are statements generated?

Checking account statements are generated monthly at month end (these are combined statements so all accounts under that number print on the statement). Savings (only) accounts generate a quarterly statement at month end.

At what age can I open a checking account?

A checking account can be opened at age 16 with an adult joint owner OR at age 17 ½ without a joint owner required.

What is the cost to order checks?

The cost varies depending on the quantity and type of checks ordered. For pricing information, please call us at 716-648- 4411 or visit your local branch.

Can I have a Debit card?

Yes. With a checking account you are able to apply for a debit card to use for ATM withdrawals and to make purchases anywhere VISA is accepted.

What is the Meridia Community Credit Union routing number?

The Meridia routing number (aka ABA number or routing transit number) is 222380731.

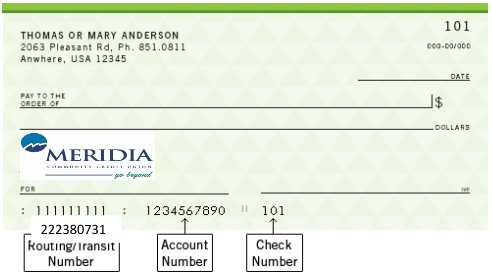

Where can I find the routing/transit number on my checks?

Can I set up direct deposit?

Yes. You will need to provide Meridia’s routing number (222380731) as well as the 14-digit micro number associated with your checking account in order to set up direct deposit for your Payroll, Retirement Benefit, Social Security Benefit, etc. If you would prefer to have your direct deposit go to your Savings, you will need the routing number above and your member number.

Do you offer Overdraft Protection?

Yes. We offer a number of options for overdraft protection on your checking account. Visit a local branch or feel free to call us at 716-648- 4411 to speak with a representative regarding more details on overdraft protection.

Do you offer online banking?

Yes. Our online banking service is called GoOnline. We also offer a mobile app called GoMobile. If you have a smartphone, download our app through the Apple Store or Google Play for easy access!

Note that you need to be registered for online account access in order to use GoMobile.

How can I deposit a check?

- By visiting a teller at your local branch.

- By mailing the check to:

- Meridia Community Credit Union, 4500 Southwestern Blvd, Hamburg, NY 14075

- At one of our Meridia owned ATMs.

- At one of our Meridia night drops.

- Using our Remote Deposit feature available on our mobile app.

How do I retrieve my checking account activity?

You can retrieve your activity in any of the following ways:

- Visit a local branch

- Call 716-648- 4411 to speak to a representative

- Call 1-800- 360-1461 or 716-648- 4411 option #2 and follow the prompts for Audio Response

- View the monthly statement you receive in the mail

- Sign into online account access – statements are available online if you are signed up for e-statements

- Use GoMobile, Meridia’s mobile app

Are there daily limits with the Debit card?

At an ATM you can make a daily cash withdrawal of up to $500 or an amount equal to your available account balance, whichever is less.

Merchant transactions have a daily limit of $5,000 or an amount equal to your available account balance, whichever is less.

How do I order checks for the first time?

The first order through Meridia must be placed with a Meridia representative. This can be done by visiting your local branch or by calling 716-648- 4411 to speak to a representative.

How do I re-order checks?

You can reorder checks any of the following ways:

- By visiting your local branch

- By calling 716-648- 4411

- Online

Get a Checking Account that Takes You Beyond

You probably already use a checking account. Why not use one that earns you money with no strings attached?